Everything you need to know about buying your own health insurance (but didn’t know to ask)

Here at Friday Health Plans, we’ve outlined everything you need to know before diving into the health insurance shopping period. And with Open Enrollment around the corner (November 1 – January 15), now is the perfect time to brush up on your knowledge.

Pick the Right-Sized Plan for You

A smart way to approach saving on health insurance isn’t always by comparing monthly premiums. It’s by evaluating health plans based on how much you’re going to pay over the course of the year when you add up premiums (your monthly payment to have insurance) and the costs you pay for medical services and drugs.

Even if two plans have the same premium, if one requires you to pay a lower cost for doctor visits and prescriptions, it could save you money in the long run.

For example, some plans cover generic prescription drugs for free, which can save you hundreds of dollars annually compared with other plans with the same monthly premium.

Honestly assess what healthcare services and drugs you’re likely to use for the whole year. That will help you select a plan that covers what you need and avoid paying for plan perks you aren’t going to use.

See if You Can Score Financial Assistance

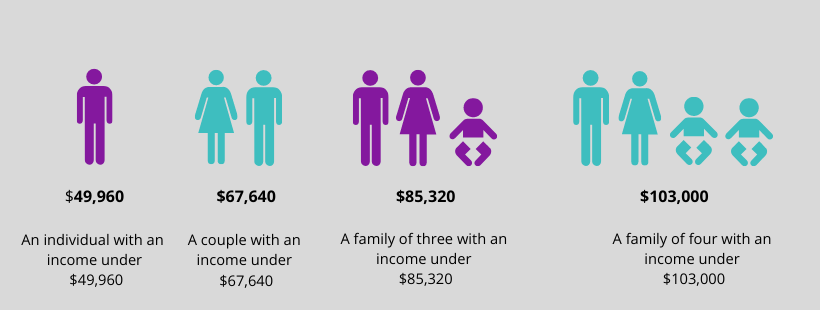

Financial aid for health insurance, otherwise known as a federal subsidy, is a type of financial assistance that can lower your monthly premium or reduce your out-of-pocket medical costs. The Advanced Premium Tax Credit lowers your monthly payment while a Cost Sharing Reduction subsidy helps lower the cost of deductibles, coinsurance and copays.

Whether you qualify for subsidies depends on your income, family size and the cost of health insurance in your area. Check your options for a subsidy through the healthcare exchange in your state.

Household Size to Qualify for a Health Insurance Subsidy

Shop Around for the Best Deal

You’d be surprised at how many independently insured people sign up for the same plan each year without shopping for better options. Would you make a major purchase at Target without checking the price on Amazon? Nope. So take the time to compare your current plan with new offerings to be sure you’re not paying more than you should for similar coverage.

If you don’t have a chronic illness, only see the doctor a handful of times a year and have minimal generic prescriptions, it doesn’t make sense to have the Tesla of health insurance plans.

Look for a plan that covers what you need most, and acts as a safety net in case of an unexpected emergency.

Check out alternatives to your employer health plan—for yourself and your family members

During the open enrollment period for individual health insurance, take a look at the individual health plans offered on the open market—you might find one with benefits and a price that fit you better.

Your company may contribute financially to your insurance premium cost, but they may not contribute to your spouse’s or kids’ plans (if they offer it to them at all). In that case, it probably makes sense to shop for private health insurance for your family members to see if there are other plans that fit their needs at a more appealing price point. You could be surprised at the savings you find here.

Skip the Shortcut: Going Uninsured is Risky Business

Do you think since you haven’t been to the doctor in years and don’t have any prescriptions, it’s smarter to just skip insurance altogether? Helpful Hint: it’s not smarter.

You’re leaving yourself open for financial catastrophe. Without health insurance, a car accident or major unexpected illness can turn into bankruptcy in a matter of weeks.

Every day you’ll need to worry about avoiding injury or illness—forget carefree skiing, travel, dance parties, bike rides or commuting with germy passengers. That’s a heavy burden to bear, not to mention the cost of getting treated if you do crash or get sick.

Get a comprehensive ACA-compliant plan, or risk saving a dime to spend a dollar (or a few thousand)

For more information about open enrollment and how to find a plan that works for you, visit www.fridayhealthplans.com.